One of my first ever posts on this blog was about savings rates and how best to calculate them given taxes, passive income, mortgages and so on. It was one of the reasons I started this blog, to try and make sense of it all. Since then I’ve been religiously updating my spreadsheets from month to month, keeping track of my spending and net worth, and over time I have come to a fairly consistent method of working out my savings rate. Now, everyone has their own method, and I don’t for a minute claim to have discovered the perfect way, but I like my method and I felt like I wanted to share it with you all. So here you are.

Technical FI vs. Comfortable FI

I make a distinction firstly between technical and comfortable financial independence:

- Technical FI is where your passive income overtakes your expenditure. Very simply, you could give up your job and your income from passive investments would be enough for you to get by on.

- Comfortable FI is a lot harder to define, and is probably different for every one of us. There has been a lot of discussion over Safe Withdrawal Rates (SWR), that is, what you can withdraw from an investment pot without it ever running out. On the other hand for some, comfortable FI means having a certain amount of ‘fun money’, extra disposable income with which to live a varied, fulfilling life. For others still, comfortable FI means they can even help their children out with university fees, or a deposit on their child’s first house.

For me currently, my primary goal is to reach Technical FI. I work in an industry where the threat of redundancy is always there in the background, and I want to reach the stage where I don’t need to worry about what I would do if I lost my job. It’s a psychological need really, because the chances are I wouldn’t go out and quit my job straight away once I met Technical FI, but it’s well documented that those that have reached that stage feel a lot more safe and secure, and are able to take greater liberties than they otherwise would. It’s definitely a good place to be.

Of course, once I reach Technical FI I probably wouldn’t stop there. I would like to have a decent life beyond just getting by, and I would like to give my hypothetical children the best start in life. In any case the distinction is an important one when it comes to working out your savings rate IMHO.

The Math is Simple, Shockingly Simple…

…as Mr Money Mustache (MMM) once said. Save only 10% of your income, he says, and you’ll have to wait 51 years before you can retire. That’s a loooong time. Save 50% of your income on the other hand and you’ll be able to retire in 17 years. Save 70% and you can do it in 8.5 years. Those are some motivational numbers right there.

Of course MMM was making some significant assumptions. First that you’d get a 5% return on investments after inflation is taken into account. Second that you’d want to accumulate an investment pot from which you’d have a 4% SWR. Why the difference (5% vs 4%)? The difference is because MMM is talking about Comfortable FI, not Technical FI. If you gave up your job expecting a 5% SWR you’d be playing a risky game – although we can reasonably assume 5% on investments when predicting how long it will take to FI, once you’ve actually taken the leap there is a lot more at stake, and you could end up losing it all if you had a few bad years.

(Of course, some would say a 4% SWR isn’t that responsible, that really a SWR of 3% is safer, or even 2.5%, but let’s not get into that discussion here.)

The other major assumption MMM made is that you’re starting from a net worth of zero. Of course, most people have already made some progress along the road to FI, whether it’s with their pensions, or the equity in their house, or just some savings. In which case, is it correct to say that a 50% savings rate would equal 17 years to FI? No (which I’m sure MMM is aware), your progress to FI won’t take that long.

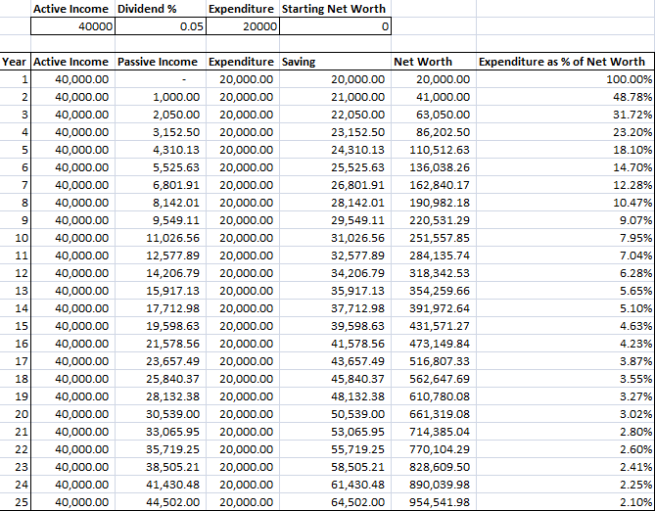

I thought to myself it would be interesting to make an Excel document to see, not just how long it would take to reach Comfortable FI, but also how long would it take to reach Technical FI. I also wanted to see how it would look if I already had some investments. I wanted to be able to choose the income level, and the expenditure level, and I wanted to be able to adjust the dividend rate and the starting point. So this is how it began:

As you can see, at the top I can choose my parameters, and then I can see year by year the progress made. In this case I’ve set the income at £40k and expenditure at £20k, thereby producing a 50% savings rate if only those factors are taken into account. I’ve set the dividend rate at 5% and the starting net worth at £0, and I’m assuming that inflation is flat (inflation would make all the figures rise together so in theory we can ignore inflation).

In this scenario, Technical FI (ie the point at which passive income overtakes expenditure) is reached at about 15.5 years. Comfortable FI at a 4% SWR is reached at 17 years (as MMM says it will), and to reach a 3% SWR it would take 20 years.

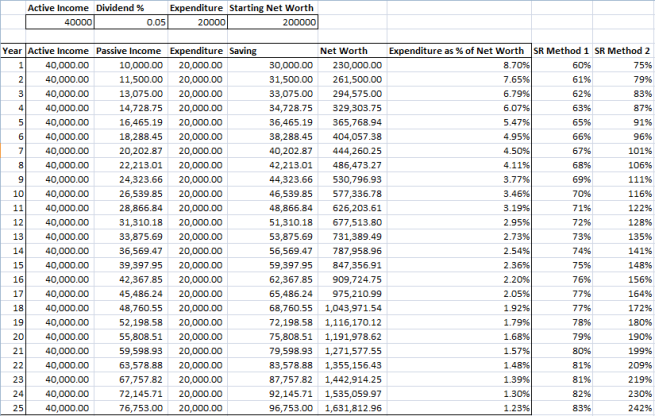

Now, keeping everything the same, I input a starting net worth of £200k:

As you can see, with a £200k starting point and a 50% savings rate, passive income overtakes expenditure after about 7 years, the 4% SWR is reached at just over 8 years, and the 3% SWR closer to 12 years.

(Interestingly, at high savings rates, Comfortable FI at a 4% SWR usually occurs just over a year after Technical FI – could this be the origin of One More Year (OMY) syndrome?)

Note that the £200k starting point doesn’t mean Technical FI in 7 years for everyone saving 50%. If my income and expenditure were lower (say £30k income and £15k expenditure), then I’d reach Technical FI sooner from a £200k starting point. Likewise if my income and expenditure are higher (still at 50% savings rate) it will take longer.

Active vs Passive Income and the Savings Rate

One thing that always bugged me about MMM’s shockingly simple math was that I couldn’t see how you’d ever get to a 100% savings rate. That is, no matter how high your income, if you spent even a penny then you don’t have a 100% savings rate. This is where the distinction between Active and Passive income comes in.

A quick definition:

- Active Income = The income you have to get up off your arse and do something to earn, in most cases your job.

- Passive Income = The income you earn without doing anything, typically from investments like stocks and shares, rental properties, P2P lending perhaps, royalties. I would only include savings accounts here if they earn over and above the inflation rate, and in that case it should only count the real income, ie the difference between the interest and inflation.

There are of course grey areas, if I had a home business that mostly ran itself but I had to put in some hours each week then maybe I’d class that as 20% active, 80% passive perhaps (or you might say you have a very high hourly rate I guess!) Personally I have an HMO (house of multiple occupancy) rental property and I find new tenants myself, deal with repairs, contracts etc, and so for the most part it is passive income but there is an active element to it. For now let’s ignore this issue as it doesn’t impact the figures massively.

Now as I see it, when it comes to working out your savings rate, passive income should cancel out expenditure. Put it this way, if your passive income exceeds your expenditure then you’ve reached Technical FI. You could say: Look, my dividends from my investment accounts last year covered all my bills, all my spend on food, clothes, holidays, and so on – I could have given up my job and it wouldn’t have made a difference to my lifestyle. In that case, any extra income earned is 100% saved right?

So whereas before you might just combine your active and passive income into one bucket called ‘income’ and say:

savings rate = 1 – (expenditure/income)

I would say this is incorrect and actually it should be:

savings rate = 1 – ((expenditure-passive income)/active income)

This does make a big difference to your savings rate. If for example I earned £30k (after tax) and £10k in dividends from investments, and I had £20k expenditure, then under the original definition I might say my income is £40k and my expenditure is £20k therefore my savings rate is 50%. If however I say that the £10k dividend cancels out £10k of expenditure, then my income is £30k vs £10k spend and my savings rate is now 67%.

The point is, looking at MMM’s figures, a 50% savings rate equals 17 years to FI, whereas a 67% savings rate means 10 years. That’s a big difference. In a sense though, to have a £10k dividend each year probably means you already have a sizeable investment pot, so it’s a bit like saying you’re already 7 years along the path to (technical) FI.

Anyway, I thought I would put this new formula into my spreadsheet and see if this works. I mean, obviously it will, because if my passive income exceeds my expenditure then my savings rate under the new definition will exceed 100%, but it’s nice to see anyway:

The two savings rate calculations are on the right of the spreadsheet. As you can see, using the first calculation I would never reach a 100% savings rate, even when I’m well past the point of Technical or Comfortable FI. Using the second calculation however you can see that I get to a 100% savings rate at about the 7 year mark, the same as when the dividends overtake the expenditure (ie Technical FI).

If you want to have a play around with this spreadsheet, here it is:

In the near future I plan to write a post on mortgages and imputed rent, but it made sense to iron out these definitions above (of technical vs comfortable FI and active vs passive income) first, because what follows on mortgages is very much based on these underlying assumptions.

How do you work out your savings rate? What do you think of my approach?

Thanks for reading,

Wephway

Hey Man,

Another thing missed from your spreadsheet are dividend increases which can make a massive difference over time! But trying to add those in just cause futher complication.

I think it doesn’t really matter how people describe their saving % when they start getting close near the end. It also depends on if they paln to sell their 4% a year or live off dividends. It could be argued that people who wait to the 100% days and plan to live off dividends have actually worked too long, due to dividend increases. If they built a stash of cash for 18 months or so and supported the deficit for 3 maybe 4 years, they could be out earlier. Either way would be nice to be there now.

Hope your keeping well.

LikeLike

Thanks Marty,

Yes I think people are more interested in savings rates when they’re just starting out on the road to FI, and probably more interested in safe withdrawal rates when they get closer. That’s just what I’ve noticed anyway. I’m very much closer to the starting line than the finishing line hence my fascination with savings rates.

I agree, as you approach FI there is a snowball effect where your dividends take over, and for most people assuming they’re not really unlucky with the stock market they could actually retire earlier. But of course you might be that unlucky sod who quits his job just before a major recession so… who knows really. I’ve seen very detailed analyses on safe withdrawal rates on other blogs so I’m not going to attempt that sort of article just yet!

Cheers, W

LikeLike

A great article. I think that I am what you may call at the technical stage. I just want to say that it is important to remember that one has to have a life as well as saving for retirement. Try not to postpone everything until that “some day.” Very thought provoking. Thank you.

LikeLiked by 2 people

Thanks, I would love to be at the technical stage, good work on getting there! I suppose there is a balance to be had between living for today and saving for tomorrow and I’ve certainly tested that this year with my somewhat extensive holidays… From my perspective it’s all about being mindful of what we spend our money on, focusing on what brings happiness now and in the future. And it’s also about strategy too I suppose, not buying the biggest house because that’s what we’re told we should do, or an expensive car because we got a pay rise at work. And so on.

Cheers, W

LikeLike

Hi Wephway,

Very well explained and actually this makes total sense to me having seen the spreadsheets like this!

I think I always knew this in the back of my head but never got around to running similar spreadsheets myself to iron out exactly how it would pan out.

MMM’s formula for savings rate only actually works if you have zero net worth and zero passive income. It’s a great way to start but once you have some NW and PI under your belt it makes sense to flip it over to your method of SR calculations.

Having said that… I don’t think I’m going to change mine any time soon to maintain consistency… Or actually a better idea would be to calculate both, and post them both on the blog, at the risk of confusing readers even further 🙂

I’ve always struggled with how to factor in the mortgage as well, and never got around to ironing that out, so I’m eager to read the next instalment to find out your thoughts on that one! I knew my laziness on that front would pay off eventually, haha!

LikeLike

Thanks TFS,

Consistency is important too, especially if you want to compare how well you’re doing from month to month and from year to year, so I totally understand. And ultimately it’s not that important being accurate with savings rates, I’m just a bit of a geek when it comes to such things!

My post on Imputed Rent is almost ready, let me know what you think!

Cheers, W

LikeLike

Thanks for a thought provoking article.

In assessing progress towards FI and following the MMM article I use two annual measures

(1) Savings Rate = Savings / (Active) Income = 1 – Expenditure / (Active) Income

(2) Spending Multiple = Net Worth / Expenditure

When your spending multiple reaches 25 then you need a 4% withdrawal rate or Comfortable FI by your definition.

You have combined these two things into a new definition of savings rate including passive income such that when savings rate = 100% your passive income matches expenditure.

This probably works OK when your passive income is very steady. However for people with significant equity investments the total return varies a lot from year to year. That makes it very hard to disentangle frugality / lifestyle inflation from investment returns. In fact the variation in investment returns can swamp everything else.

So for example if you have cut your expenditure a lot, but the stock market is down then your savings rate (but your new definition) will fall.

Probably depends a bit on your circumstances as to what is the most useful.

LikeLike

Yes, I did notice when I started tracking my savings rate this way that my savings rate from month to month was a lot more volatile. Some months I could have a savings rate over 100% whereas other months it can drop to below 50% even when my actual spending hasn’t changed that much. Over the course of a year it levels out somewhat so it’s more useful as a measure from year to year. But like you say, if your investments fluctuate from year to year then you’ll have volatility even then.

I don’t see a way round that really, it would still be nice to try and map out how long it would take to reach FI. I’ll have a think about it,

W

LikeLike

This is a nice definition of savings rate, where the passive income is covering off your expenses.

But there is a problem if I don’t need to get up off my arse and earn any active income at all (because my passive income more than covers my expenses).

In this case you end up dividing by zero.

So the SR ends up as 1 – infinity. No idea what that actually is but it would be nice 🙂

LikeLike

Thanks. Yes I noticed that when I was doing my example at the end, you really need to have some sort of active income to make the equation work. Perhaps just put in £0.01 as your active income? In any case it’s a nice problem to have!

LikeLike