It seemed like FIRE was everywhere last month (or ‘The Fire Movement’ as it now seems to be called). I’m not sure exactly what triggered it, I think it might have been this New Yorker article, but suddenly I was seeing articles everywhere, in The Times, The Torygraph, The Guardian, The Daily Fail. I was seeing articles about Mr Money Mustache and The Escape Artist. I even saw relative newcomer Young FI Guy being interviewed in one article.

Of course there was the usual backlash. It doesn’t hurt to listen to some counter-arguments, in fact it may be good to consider alternative viewpoints to make sure you’re doing the right thing, but a lot of comments under the articles were very poorly thought out IMHO. Such as:

- You have to live like a hermit/miser/tramp etc.

- You’ll probably get hit by a bus/fall off a cliff/die of a disease the day after you retire

- You can’t do it if you have kids

- You have to be super rich and/or super lucky

- You’ll be bored when you retire

And so on and so on. It’s funny actually because the same thing happened just over a year ago I seem to recall, when Channel 4 made a one-off documentary ‘How To Retire at 40’. That show was rubbish and seemed like a missed opportunity to me. There were some related articles, including a BBC article with the ‘Our Tour‘ blog. And of course the usual backlash ensued (‘They don’t have kids’, ‘They earned high salaries’, etc etc).

The truth is, I just don’t see FIRE ever becoming a popular movement really. And that’s because, to my mind, your average FIRE enthusiast needs at least two (if not three) of the following qualities:

- A certain idealism, almost radicalism. It’s not just about cutting out that daily latte, or taking a packed lunch in to work, though that probably helps. It’s about seeing life completely differently. Not trying to keep up with the Jones’s but doing things your own way; living in a modest house, buying a second-hand car, buying a decent budget phone rather than a £1k+ phone, avoiding brand names, and so on. The question is not, ‘how do I scrimp and save’ but, ‘what actually makes me happy?’

- An independent mindset. Like the above I suppose, you’ve got to think for yourself, not just follow the herd. (Unless all your friends are planning to retire early of course but that sounds unlikely.) You need to be able to spot when you’re being advertised something and not get sucked into that.

- A brain, at least, enough to research and act for yourself. It helps to get your head round the maths, to understand why compounding works, what passive investing is, and so on. You’ve got to do research yourself, and understand why it’s foolish to throw all your money at a stock broker. Recently I did a bit of modelling on excel to prove that investing in property is a solid long-term plan. But I also did a lot of reading around the subject. You’ve got to get yourself a ‘financial education’ as Kiyosaki once said.

- Earn more than the average. I mean, this is probably the most contentious one, as I suppose it’s not possible for everyone to earn more than the average (it’s statistically impossible actually). But there are ways to boost your income and give yourself a better chance of earning more. That requires a little bit of ambition, but also some intelligence, some hard work, and yes some luck.

Anyway, who am I to comment on all this, I’m still years away from financial independence. Actually in all seriousness I’m quite happy FIRE is a niche idea, I don’t like the idea of everyone being super-frugal or retiring early. If everyone stopped buying BMWs and Audis (on credit I might add) what would that do to the manufacturing industry? Debt and consumerism and greed are what make the economy go round and I’m happy for it to continue that way. I just don’t want a part of it myself.

September 2018 Review

So what did I get up to in September? It was a fairly exciting month actually. My girlfriend finished moving in with me, handing her old flat keys back earlier this week. My house is currently full of boxes and I’m not really sure where everything is going to go, but I’m sure we’ll find a way. It’s great news, mainly because I’m looking forward to living with her, but also because she won’t be paying rent and bills on her flat and will probably have £800+ extra a month. I said to her I don’t need anything for rent/bills, not while I have two lodgers living upstairs, and actually I think I’ll save money as I won’t be doing so much driving all the time to see her.

The remortgage for my rental property all went through without any hitches. The house is an HMO (house of multiple occupancy) and as such it is treated a little like a business by mortgage lenders. So as I was showing the valuer round I was talking through the rents and outgoings and work I’d done to the house. He actually said I was undercharging on rent, but I think I talked a good talk because he made all the right noises and I found out a couple of days later he’d valued the house the same as I had. I’ve actually released a lot of equity for this house so you’ll see in my net worth graph below my debt and overall assets (which includes cash in bank) have gone up. I’m planning to hold onto this for the next 5-6 months and either look to buy another rental property next year, or possibly a house to live in with my girlfriend and rent out my current property.

I had a couple of heavy nights out, and if I’m honest it put me off drinking a little. I’m not sure what happened the first night – I left the bar about 3am to take one of my workmates home (he was a state), then found out the next morning one of my other workmates had been mugged (or got into a fight or something) and had some nasty face wounds to show for it. Then the second night I lost my wallet, which was really annoying – I didn’t actually realise until two days later when I went to the gym and found I didn’t have my gym card. Fortunately no money had disappeared from any of my bank accounts, but I had to spend money on a new wallet and a new driving license.

Finally, in the last week of September, we went to New York. We stayed in the city for 4 days, watched an ice hockey game, went up the Empire States building (twice), went for a night time boat road, and more besides. Then we went upstate for 3 days to see my old uni friend and his wife. I was most struck by how much space there is up there, it seemed like every house had a massive garden stretching all around, there were trees and forests everywhere, and you had to drive several miles just to get to the nearest pub (apparently they all just drink-drive). It was good to catch up with my old friend who has developed an American twang to his Yorkshire accent.

Most of my pictures from New York have me and my girlfriend in, but here is a fairly awesome picture I took stood at the foot of the One World Trade Center:

Also, here’s an apple tree from the cider mill we visited in upstate New York:

So, how did my spending and income stack up for September?

Spending:

- Mobile phone – £20.

- Imputed rent – £550 – I own my house (with a mortgage) but I pay myself rent. I don’t actually move any money around, but for the purposes of my spreadsheet and my savings rate I treat my house as though it were a rental property and I am a tenant in it.

- Food, drinks, toiletries – £193.56

- Eating/drinking out, takeaways – £96.68 – Much better than normal but that’s because I only include in this figure what shows up on my bank statement. I made a lot of cash withdrawals (see below).

- Petrol/travel – £166.77

- Car expenses (insurance, repairs etc) – £120 – I bought some new tires after noticing my current ones had completely worn down to the point there was metal fibres showing. I’m not sure how this happened, I only had my MOT in July, I’d have thought they’d have flagged up low tread on the tires. One of the tires was bulging in one part, that’s pretty dangerous I think…

- Gym/Sports – £30

- Music/gigs/cinema – £79

- Cash Withdrawals – £460.81 – Mostly US dollars for our holiday.

- Miscellaneous – £700.62 – Holiday related stuff – mainly hotel costs.

- Bank charge – Negative £10.31 – ie they paid me.

Total: £2407.13

Income:

I split out my income into active and passive – passive is basically my rental income, active is everything else.

- Salary (after pension/sharesave removed) – £2289.50

- Pension payment – £899.16 – I put in 6%, my employer puts in 20%

- Sharesave – £250

- Matched betting – £0

- Rental Income (after bills, expenses, council tax and mortgage interest removed) – £1273.58

Total Active Income = £3438.66

Total Passive Income = £1273.58

My Savings Rate

I work out my savings rate by using passive income as an expense reducer. So in this case my spending is £2407.13 minus £1273.58 which equals £1133.55. As my active income is £3438.66 and my spending is £1133.55 that makes my savings rate 67.51%.

See my earlier posts here and here if you want a bit more explanation on how I work out my savings rate.

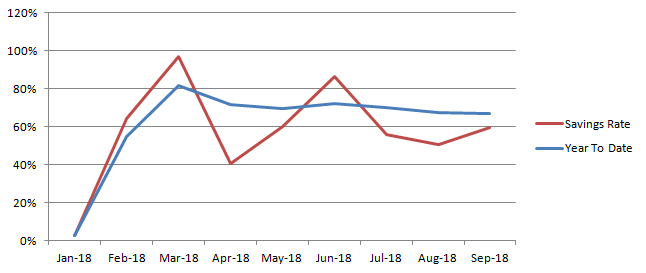

Here is my month to month and year to date savings rate:

My savings rate for the year is currently sitting at 67.51%. I’m still hoping to make a 70% savings rate for the year as I don’t have much planned for the next few months, but there is the small matter of my self assessment income tax which I have a feeling is going to be quite a lot this year. I might work it out early actually, though I probably won’t pay it til later in December.

My Net Worth Tracker

My net worth increased in September from £227.933.13 to £229.474.56, a £1541.43 increase. This is based on the estimated values of my properties minus my debts (mortgage/loans etc), plus my savings, plus my investment accounts (including pension) and the total of my bank balances.

About £1.5k (ie nearly all) of this increase is thanks to me saving my income (well, not spending it all is perhaps a better way of putting it). There has been very little increase in the value of my assets this month – it seems the slow down in the economy is really starting to bite. But also my debt increased by £2k when I remortgaged my rental property because of the cost of the fixed term mortgage. I did consider putting this down as a cost and therefore reducing my savings rate for the month, but it seems a bit of an anomaly – yes it’s an expense but it meant I could get a better interest rate for the mortgage. I suppose I should average the £2k out over the term of the mortgage, ie 60 months, making the cost about £33 a month, but I’m not sure I can be bothered to do that so I’m just decreasing my net worth by that much.

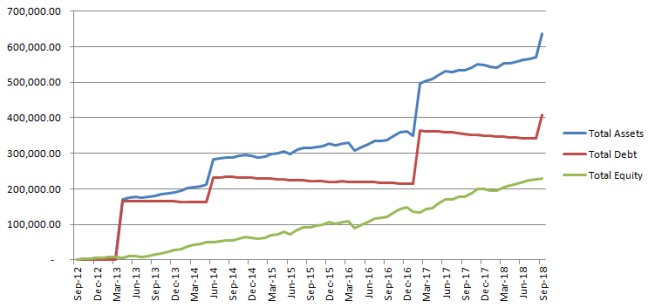

Since this time last year I estimate my net worth has increased by £51,312.60. Here’s a lovely graph to show how my net worth has increased since September 2012:

There you go, that little spike at the end in both the assets and debt lines shows me releasing some equity from my rental property. I have to admit, I don’t think I’ve ever seen so much money in my bank account and it scares me a little bit, but I’ve transferred it all over to savings accounts until I’m ready to use it.

And that’s about it for this month, here’s hoping October is a bit quieter.

Thanks for reading,

Wephway

Great article wephway. Amazing picture of the one world trade centre. I find that whole site really moving when I go there.

I keep debating about property but I just can’t make the numbers work at least round here in reading. I may look up north but need to really research where to buy and what yield to aim for as property to me just feels too illiquid and too concentrated . Its the passive income that attracts me. I have alot)of equity in my house (200k in fact).

Too big a house really is the problem (it’s worth probably 490k) i keep debating whether to release some of it.

I’ve just remortgaged a year ago and fixed for ten years so I can invest instead of overpay.

The 3% stamp duty plus high price of houses so I think little capital gain going forward puts me off. A friend of mine was selling his flat for 100k In great Yarmouth. He was getting 500 a month rent. After a mortgage its about 180 quid income. It just didn’t seem worth it though I guess that is paying the capital off so will improve as it goes.

I was also looking at the peer to peer sites that invest in property (landbay or property partner crowdproperty) as I already have about 20% of my money across 5 sites. any tips or advice on where to start with property from a research pov? ?

LikeLike

It’s interesting, one of my friends came to me with a similar scenario, 200k equity and undecided what to do with it. Basically I look at it over a 10 year time frame and think you can get more leverage by releasing equity and investing elsewhere – you’re effectively getting a loan with a very low interest rate that you can probably beat by investing it. Of course it’s risky though, and with property there are a lot of taxes and tax changes to consider, income tax, stamp duty, capital gains. And then there are regulations to consider too. Personally I’m looking at property in the town I live in, I feel I know the market reasonably well and the good places to buy. I’ve recently been listening to the Property Podcast, they seem pretty knowledgeable. But ultimately you learn best by doing, by taking the plunge. I don’t like to recommend particular options because I’d hate to feel responsible if it all goes wrong so it’s really up to you to do your research. Good luck though!

LikeLike

Great post!

I am quite new to the FIRE community. I have long had the idea that trading my time and labor for a paycheck until I am 68+ is not for me. When I tell colleagues or friends about it, I often get the ‘but what will you do?!’ response. But I am not married to by job. My sense of identity does not depend on it. Neither does it depend on driving an expensive car or wearing designer clothes.

To live a modest, free life. That’s my dream.

Great to know there is a whole community out there with like-minded people!

LikeLike

Hello and welcome to the community! Although I talk about it openly on here, I tend to avoid the subject of Early Retirement when talking to people, especially with my workmates, because it raises questions over your commitment to your job, and most employers expect total commitment (which is ridiculous really). Financial Independence on the other hand is a great subject to bring up, and it is really interesting hearing what people spend their money on. And every now and then you meet someone who actually has very similar values to you. Anyway I look forward to hearing how you get on!

LikeLiked by 1 person

Thanks!

I usually talk about creating a better work-life balance, rather than saying I wan’t to retire early. It’s a bit more pleasant to the ears…who doesn’t want that after all?

But your post got me thinking so I’m working on a post in which I go a bit more in-depth into why I think a work-free life would suit me while so many other’s really can’t image a life without a full time job.

LikeLike

+1 – Amazing pic of the One World Trade Center.

Just wondering, has your gf also embraced FIRE?

LikeLike

No not yet, I’m working on her! She likes the idea of early retirement so maybe I need to work on that angle. To be honest it’s been playing on my mind a bit recently, it’s easy to work out savings rates and net worth etc when it’s just yourself, but when there’s two if you and one of you isn’t interested in spreadsheets it’s somewhat harder. I don’t want to pry too much into her spending habits either as that’s not really any of my business. But there is a lot to think about and planning ahead will be interesting so maybe watch this space!

LikeLiked by 1 person

Another one hear to say that’s an awesome pic of 1 WTC – certainly very different to when I visited in the mid-2000s!

p.s. you know there’s a FIRE-bubble when people start interviewing me! haha

LikeLike

Hi, I’ve recently found your blog through other FI blogs and have found it a great read so far! Any plans to publish your spreadsheet on long term property investing on here? I’m very pro-property as a FI strategy and have tried to create a similar thing but found there were many future variables, probably need to sit down and try to get my head around it properly!

LikeLike